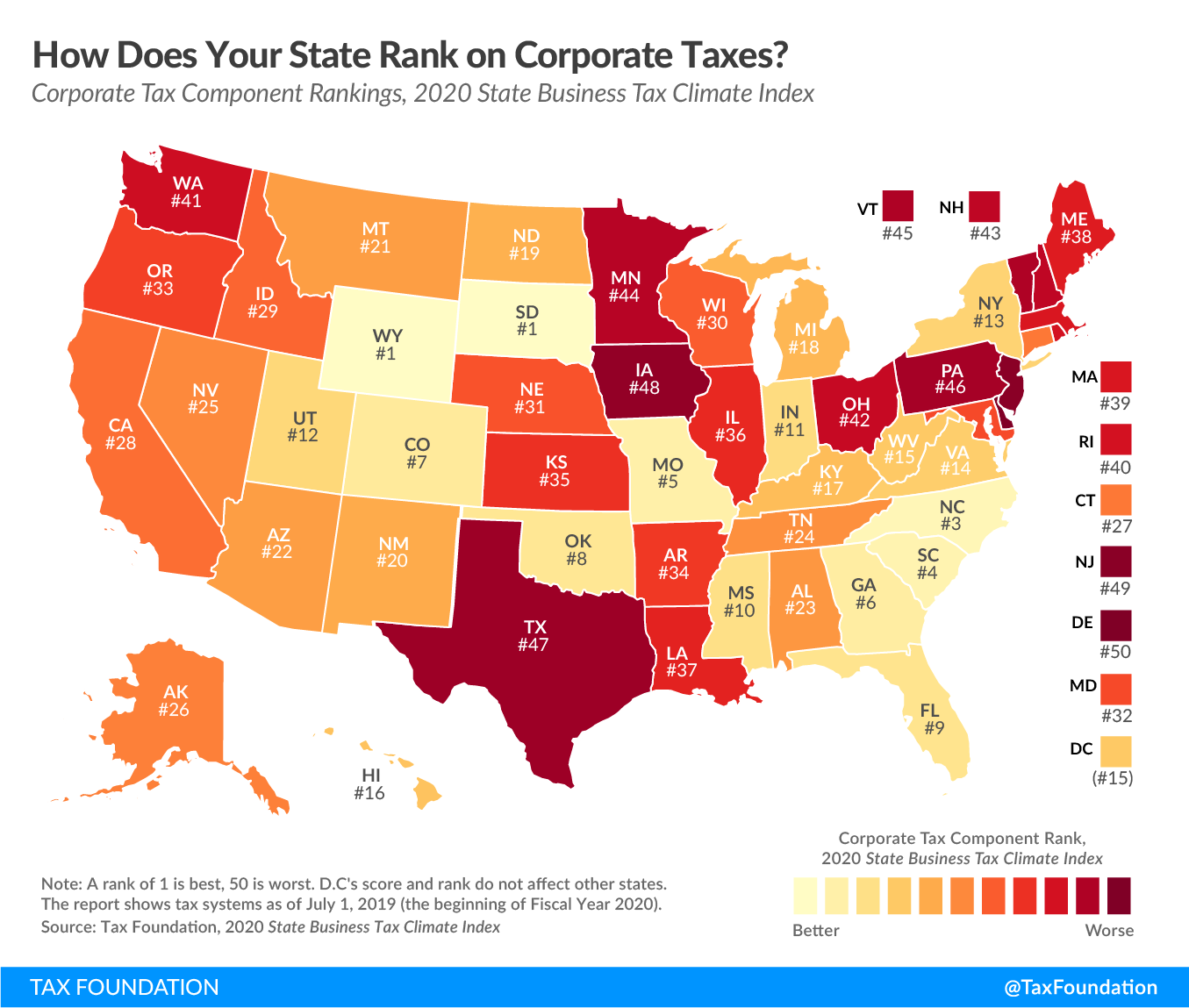

An additional 3.8 bump applies to filers with higher. Work with your fee-only financial planner to develop a plan to help minimize your federal and California state taxes. Tax brackets for long-term capital gains (investments held for more than one year) are 15 and 20. 1 percent 2 percent 4 percent 6 percent 8 percent 9.3 percent 10.3 percent 11.3 percent 12.3 percent The California marginal tax rates are higher than most of the states, but not the highest. With the stock market soaring to record highs in 2020 and many Californians earning high incomes- even during the COVID Recession- tax planning is a must. In order, here are the marginal tax rates of the California tax brackets. California Tax Brackets for Head of Household-Filing Taxpayers 0 17,629, 1.00 17,629 41,768, 2.00 41,768 53,843, 4.00 53,843 66,636, 6.00. Updated July 8, 2020: California LLC tax rates are 800 for LLC tax, an LLC fee that ranges from 0 to 11,790, and FICA tax at 15.3 of taxable wages. California cities receive 1 of the total sales tax rate collected within its. Los Angeles Times via Getty ImagesĬalifornia state tax rates and tax bracketsĬalifornia Tax Brackets for Single TaxpayersĬalifornia Tax Brackets for Married/Registered Domestic Partner (RDP) Filing Jointly Taxpayers (and Qualifying Widowers)įor other the Calfornia Income Tax Rate for other filing status visit the Franchise Tax Board site. The use tax is measured by the sale price of tangible personal property.

Capital Gains Taxes in California are sky high.

0 kommentar(er)

0 kommentar(er)